The Top 5 ways to make the most of your accounting software!

Technology is certainly a wonderful tool to relieve the day-to-day stress of any business, and accounting software is a ‘must have’ these days.

This, surprisingly, was still fairly common practice for small businesses as recently as the early 2000s, though by the early 90s, businesses were using spreadsheets with additional functions, which definitely improved the accuracy of business bookkeeping.

Thank goodness we don’t have to do that anymore!

By the late 90s accounting software was becoming well-established and has developed into the easy-to-use and understand systems we have today. So, what are some of the ways you can make the most of your accounting software?

Here’s my top 5:

#1 Tailor your Dashboard

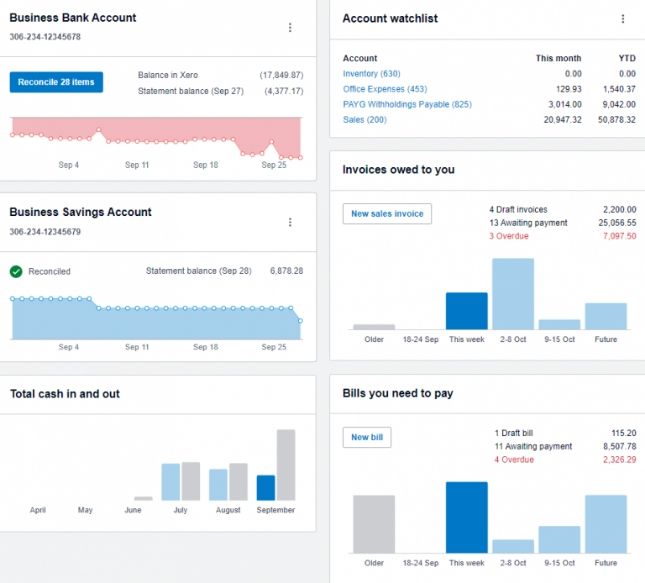

Today’s accounting systems can be set up so you see business finances at a glance. Every business is different and it’s easy now to tailor your dashboard to suit your needs. Want to know what bills you owe?

Put it in the dashboard. Want to know who owes you money? It can be right there in front of you. So make sure you set up your dashboard to give you the most important information when you need it.

#2 Connect your bank account

Reconciling bank accounts is one of the most crucial elements of your business bookkeeping. It can be tedious to wait for end-of-month statements, or even if you reconcile every day, logging into your bank regularly to download transactions.

These days it’s so easy to connect your bank account to your accounting software, and reconciling can be done in a few minutes every day. You’ll be surprised at the time you save and how easy it is to ensure your accounts are reconciled and up-to-date.

#3 Photograph your receipts or upload digital invoices

Gone are the days when every single piece of paper needed to be boxed and kept for 7 years in garages and storerooms just to keep the tax office happy.

These days, the software mobile apps allow you to take photos of your paper receipts that then reconcile with your connected bank statement. And since most invoices are now sent via email on PDF, it’s so easy to just upload that digital image to your corresponding purchase entry; no need to print out endless reams of paper. These images are then available to look at every time you want to check the transaction.

Easy-peasy! Uploading your images really does save time, paper, and storage space, while also reducing your carbon footprint.

#4 Explore other systemised apps that work with your accounting software

In today’s automated world, using technology to improve your everyday tasks has become the norm, and when they integrate with your accounting software, it’s even better.

When it comes to finding apps that work, talk to us at WestBAS. We are more than happy to help you discover and integrate the apps that will best support you in your business.

#5 Accounting software is now fully connected to the ATO

Since the implementation of STP over the last couple of years, accounting software now uploads payroll details direct to the ATO. This makes things so much easier, especially at the end of the financial year, as businesses finalise their payroll with immediate integration.

STP phase 2 came into effect on the 1st July 2021, but depending on the software platform you use, there may be exemptions while they continue to develop compliant ATO reporting within their software.

The implementation of STP2 will mean the end of Separation Certificates, reporting income for welfare recipients, and better reporting of income for child support payers. You can read more about it on the ATO website here.